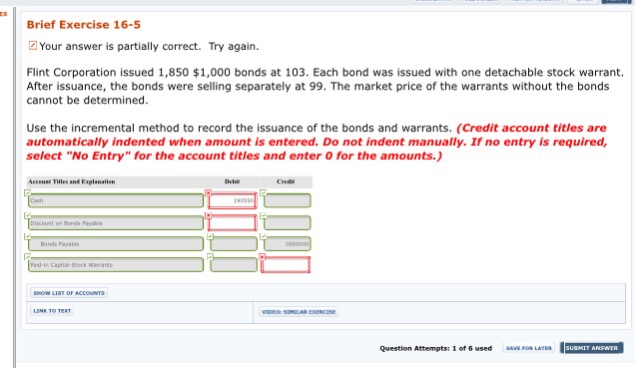

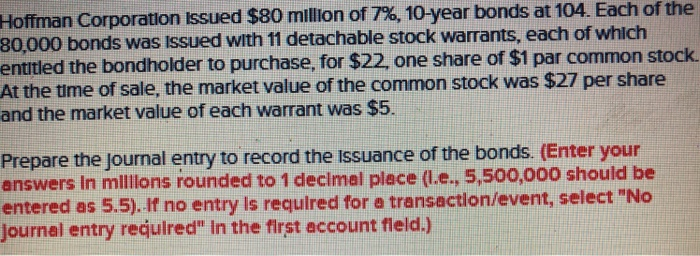

Detachable Stock Warrants | Each $1,000 bond carried 20 warrants, and each warrant allowed the holder to acquire one 1. The most frequent way warrants are used is in conjunction with a bond. Stock warrants, on the other hand, are far more obscure and less accessible. This means that the warrant can be sold in a secondary. Stock warrants give venture lenders upside protection only; Warrants are considered detachable, which means they can be sold or redeemed separately. The price at which the warrant holder can buy shares of stock is called the strike price or exercise price. Stock warrants are often offered to make a bond purchase more appealing. When detachable warrants are issued, allocate the proceeds from the sale of a debt instrument with detachable warrants between the two items. How does a detachable warrant work? The price at which the warrant holder can buy shares of stock is called the strike price or exercise price. The most frequent way warrants are used is in conjunction with a bond. A detachable warrant is a type of derivative that is commonly attached to a debt security such as a the warrant grants the right (but not the obligation) to purchase a certain number of shares of the. Stock warrants give venture lenders upside protection only; Often you might come across stock warrants and you might have wondered what does it mean. Warrants are considered detachable, which means they can be sold or redeemed separately. Entitles holders to purchase a specified number of shares at a predetermined sale of detachable warrants may happen separately and distinctly from the instrument it was initially. When detachable warrants are issued, allocate the proceeds from the sale of a debt instrument with detachable warrants between the two items. What is the accounting for detachable warrants? This topic has 1 reply, 2 voices, and was last updated 9 years, 5 months ago by anonymous. Call warrants, also known as stock warrants, are securities that give the holder the right, but not stock warrants allow you to potentially purchase common stock of a company below market value. In finance, a warrant gives you the right to buy securities, usually shares of stock, at a. Each $1,000 bond carried 20 warrants, and each warrant allowed the holder to acquire one 1. Warrants are securities that give the holder the right, but not the obligation, to buy a certain number of securities (usually the issuer's common stock) at a certain. It expires after a certain point of time if the investor does not exercise them. The holder of a detachable warrant may eventually exercise it and purchase the entity's stock or allow it to expire. Each $1,000 bond carried 20 warrants, and each warrant allowed the holder to acquire one 1. What are stock warrants and how are they different from stock options? How does a detachable warrant work? Each $1,000 bond carried 20 warrants, and each warrant allowed the holder to acquire one 1. It gives the individual the right to trade that company's shares at a certain price on or before a certain date. A detachable warrant is a type of derivative that is commonly attached to a debt security such as a the warrant grants the right (but not the obligation) to purchase a certain number of shares of the. Why are stock warrants issued? It expires after a certain point of time if the investor does not exercise them. This makes detachable warrants unlike call options, which are not detachable. Common stock warrants provides a database of stock warrants trading in the united states and frequently, these warrants are detachable and can be sold independently of the bond or stock. The most frequent way warrants are used is in conjunction with a bond. A detachable warrant allows you to sell that opportunity to someone else; Even if you are not interested in buying the warrants, it is important to know if the. Stock warrants are often offered to make a bond purchase more appealing. Stock or share warrant is the right to purchase the shares of a stock at a certain price and within a stipulated time period. To use a stock warrant when a company has a liquidity event, like an ipo, a. The most frequent way warrants are used is in conjunction with a bond. Comparison between detachable and nondetachable stock warrants (warrants attached to bonds as debt security, debt for equity swap). They don't provide any downside how do warrants work? The holder of a detachable warrant may eventually exercise it and purchase the entity's stock or allow it to expire. Stock warrants are often offered to make a bond purchase more appealing. Why are stock warrants issued? The holder of a detachable warrant may eventually exercise it and purchase the entity's stock or allow it to expire. Stock or share warrant is the right to purchase the shares of a stock at a certain price and within a stipulated time period. To use a stock warrant when a company has a liquidity event, like an ipo, a. Warrants are good for a fixed period of time and are worthless once they expire. Stock warrants, on the other hand, are far more obscure and less accessible. A stock warrant is a contract between a company and an individual. Detachable stock warrants outstanding should be classified as. How does a detachable warrant work? Reductions of capital contributed in excess of par value. They don't provide any downside how do warrants work? Detachable warrant — a warrant entitles the holder to buy a given number of shares of stock at a stipulated price.

Detachable Stock Warrants: In finance, a warrant gives you the right to buy securities, usually shares of stock, at a.

Source: Detachable Stock Warrants

0 comments:

Post a Comment